- Kenya’s SACCO sector continues to play a vital role in providing affordable financial services to Kenyans.

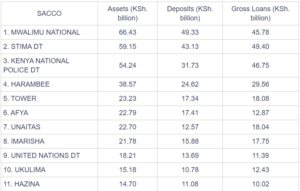

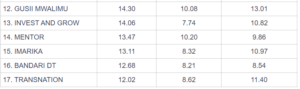

- According to the Sacco Societies Regulatory Authority (SASRA), SACCOs disbursed loans totaling KSh 758.57 billion in 2023.

Leading the pack are Mwalimu National and Stima SACCO, offering up to KSh 40 billion in loans each.

These SACCOs offer a blend of competitive interest rates and flexible terms, making them attractive for individuals seeking loans or investment opportunities. With total assets nearing KSh 1 trillion, SACCOs are becoming essential players in Kenya’s financial landscape.

How much do Kenyans deposit in SACCOs?

https://x.com/DrOparanya/status/1834143940439687625/photo/4

According to the SASRA report, Kenyan SACCOs saw a total deposit growth of 9.95%, increasing from KSh 620.45 billion in 2022 to KSh 682.19 billion in 2023. This growth was fueled by a 6.57% rise in membership, which grew from 6.42 million in 2022 to 6.84 million in 2023. This highlights the increasing trust and participation in SACCOs across the country, as more Kenyans choose to save and access loans through these cooperative societies.